Inside the DeFi (Decentralized Finance) world, maybe the most popular activity it’s the yield farming. This is the process in where an investor can provide liquidity (funds) to a decentralized finance platform and receive in exchange some juicy rewards in Liquidity Provider (LP) tokens calculated per year, i.e. Annual Percentage Yield (APY).

Everybody is going crazy about it because those APYs can vary from 1% to thousands and even millions. The entire process of “Liquidity Mining” on new pools is high-risk, but many have been willing to give it a try or develop new decentralized financial tools.

According to DeFi Prime, there’re in existence more than 200 projects on this category, while DeFi Pulse describes there’re +10.3 billion dollars locked (invested) in these projects. If you’re in the team who’s willing to try and already has some knowledge about it, we have for you today the 5 best-performing platforms to practice yield farming.

UMA Project

Universal Market Access, better known as “UMA”, is a DeFi protocol with its own homonymous token. The main promise offered by this system is the ERC-20 Token Builder to create “priceless synthetic tokens”. To define its own price without oracles, these are capable to track the price of anything: since apples to the relative value of ETH to BTCAn abbreviation for Bitcoin.. Thereby, they aim to work as a financial derivative between two parties.

By now, the pair formed by its native yUSD and the stablecoin USDC has a locked value of around 688,100 USD. The reward, calculated at 1,494% yearly and 4.10% daily, is paid in UMA or Balancer (BAL) tokens. And most importantly: with a low impermanent loss.

About the UMA token, we can say that since its release in May, it has gained +363% on its value. However, since September 12 it’s been plummeting from 19 USD to only 6.44 USD, the current price. On the other hand, Balancer has been more stable since June with a price of around 13 USD, but data by CoinMarketCap shows a bad Return of Investment (ROI) for it. As we can see, the election isn’t free of its risks.

PancakeSwap

By anonymous devs with a penchant for breakfast foods and rabbits, this DEX inside the Binance Smart Chain (BSC) was launched by the end of September. Its main promise, according to the announcement on Medium, is to become “the #1 liquidity provider on Binance Smart Chain and the home of new, innovative gamified farming mechanics, many of which we suspect will make it to other chains and beyond”.

As its own devs said, it’s practically a clone from Ethereum Sushiswap, and let you farm FLIP and CAKE tokens by locking several assets. However, the most profitable pair now to lock in its pool is BURGER-WBNB, which invested value ascend to 120.644 USD and promises a 2,289% APY in CAKE tokens. The impermanent loss risk is high, though. Regarding the CAKE token, it has a current price of 0.49 USD, which represents a -64% decline since the release. That’s bad, but the system is still very new and the market capitalization is over 3M dollars.

Pickle Finance

Beyond just following the recent trend of copy Sushiswap (and therefore Uniswap, the first one), Pickle Finance born in September on Ethereum with a new promise: to incentivize users to sell stablecoins that are trading above their peg and buy ones that are below it. It also offers flash loans for smart contracts developers and let its holders vote in the governance to control the monetary policy of the system.

To date, you can use the pair PICKLE-ETH to farm some pickles with a 1,432% (promised) APY; along with the $18,414,279 of total value locked. The impermanent loss risk is high, but at least it’s been a good investment in the short term: the PICKLE token started at 5.8 USD and now reached 18.4 USD (+217.2%), despite its market capitalization is mostly unknown.

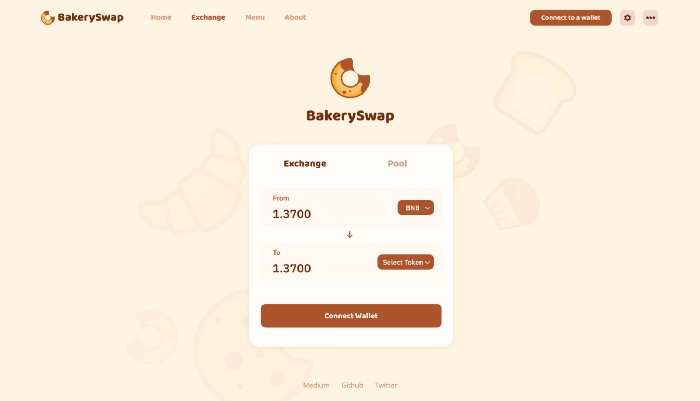

BakerySwap

An Uniswap version on the BSC with altcoin Liquidity Pools? That’s BakerySwap, another DEX to farm rewards by providing liquidity. In the words of their devs:

“BakerySwap is the next iteration of the by now infamous Uniswap. It’s like Uniswap, but faster, cheaper, and dare we say it… tastier? In addition to all of the above, liquidity providers will also be rewarded with BAKE tokens from which they can earn a share of BakerySwap’s trading fees and use for voting as part of BakerySwap’s governance”.

The best-performing pair in this pool, for now, is BAKE-BUSD, with 223,454 USD total locked value and a promised reward of 861% APY in BAKE tokens. The latter has a current price of 0.024 USD, which means a -81% decline since late September. However, its market capitalization is about to reach 2M dollars.

SUN

This one is described bluntly as a social experiment, and you may like the honesty. We suspect the name comes from Justin Sun, founder of Tron blockchain, on which the new SUN liquidity pools work. Indeed, this is a creation by Tron Foundation, with the purpose to boost the development of TRON’s DeFi ecosystem and it’s fully operated by the community.

We should mention there are other pools with better performance (like Sushiswap and PerlinX), but we included this one in the list because it let you stake WBTT and receive 99.9% APY in SUN tokens with low or any impermanent loss, while others have a very high risk of it. Maybe that’s why it has almost 3M dollars locked inside.

Regarding the SUN token, it’s being exchanged at 14.5 USD. This implies a -35.7% decline since its release, but its market capitalization (+24M) is the second of this list, only after UMA (+343M).

Important considerations about Yield Farming

Other promises in this fast-paced DeFi world we can mention are Harvest (FARM – 239.3% APY), PerlinX (BUSD/PERL – 161.4% APY), Sushiswap (YAMv2/ETH -157.9% APY), mStable (MTA/wETH – 120.7%) and dForce (DF/USDx – 80.9% APY). All of them have high impermanent loss risk, so, it’s worth being careful.

By way of conclusion, we can remember a recent survey by CoinGecko, which revealed that at least 93% of the surveyed yield farmers have reported positive ROIs, even over 500%. Although this doesn’t mean you should run to invest your life savings now and let alone we’re recommending you to become a yield farmer and/or invest in the aforementioned platforms.

The same survey revealed as well it’s very common to “farm-and-dump”, which means the farmers just wait till accumulating enough rewards before sell or withdraw their positions and the whole price might be dump to zero. So, we can’t urge you to jump in, nor we would stop you from doing it.

The decision (and the associated risks and further research) are solely in your hands. Choose wisely and happy trading!

Wanna trade BTC, ETH, and other tokens? You can do it safely on Alfacash! And don’t forget we’re talking about this and a lot of other things on our social media.

Twitter * Telegram * Instagram * Youtube *Facebook * Vkontakte