June is the month of diversity and inclusion. Therefore, today we’ll analyze how cryptocurrencies can help in financial inclusion and the transformation of traditional socio-economic schemes.

What is financial inclusion?

By financial inclusion, we mean the need for all people to be able to access basic and efficient financial products. Everyone, regardless of their economic status, gender, or nationality.

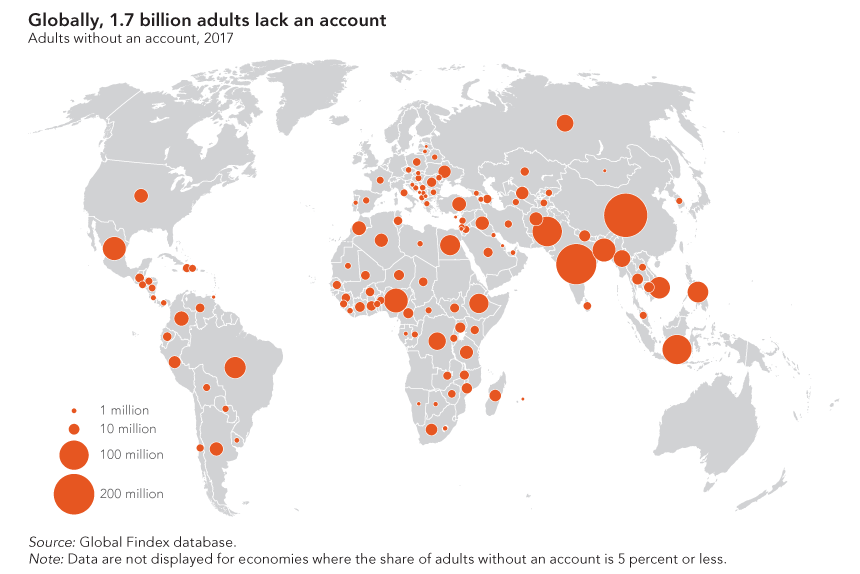

Perhaps you have imagined a world where anyone has the same opportunities to develop their skills and achieve their goals. However, this isn’t a reality in our society. According to World Bank data, by 2017, around 31% of adults in the world (about 1.7 billion) didn’t have a bank account or a mobile money provider to handle their fiat money.

In some regions, this disparity is more pronounced than in others —especially in developing countries. Bangladesh, China, India, Indonesia, Mexico, Nigeria, and Pakistan top the list.

In terms of gender, 51% of the unbanked are women. Moreover, the majority are among the poorest in their economy. Another important fact is that of the 1.7 billion unbanked, at least two-thirds own a cell phone. That’s good news because technological tools such as smartphones offer financial inclusion opportunities for the unbanked. Like access to cryptocurrencies, and even to DeFi products.

They don’t need a bank to use cryptocurrencies

A survey conducted by the U.S. Federal Reserve revealed that 13% of people in the U.S. who use cryptocurrencies as a payment method don’t have a bank account. Also, 27% of crypto users don’t have access to credit cards. The study was conducted on a sample of 11,000 people between October and November 2021.

The requirements to open a bank account are one of the main barriers to entry for these people. Likewise, the credit history in traditional financial institutions plays a relevant role. Beyond this region, in some developing countries, people don’t have financial institutions close to their homes. And high transactionA cryptocurrency transaction is an entry on the blockchain ledger, noting sender, receiver and number of coins transacted. More costs at traditional institutions can have a huge impact on personal finances.

Cryptocurrencies, on the other hand, offer access to exchanges, wallets, and even payment processors. With cryptocurrencies, geographic location or credit history isn’t an issue. Besides, fees for receiving or sending are usually low, regardless of the amount of money sent.

Cryptos as an active agent for financial inclusion

Part of the discourse from traditional financial institutions focuses on the volatility of cryptocurrencies, which would make them high-risk assets. However, blockchain technology is helping the creation of global financial infrastructure. Its revolutionary scope is like that of the Internet, which made it possible to democratize the creation, distribution, and access to information.

Regardless of ethnicity, socioeconomic status, gender, or geographic location, anyone with network connectivity is a candidate to own cryptocurrencies. This fact is crystallizing in their adoption, which turns out to be increasing.

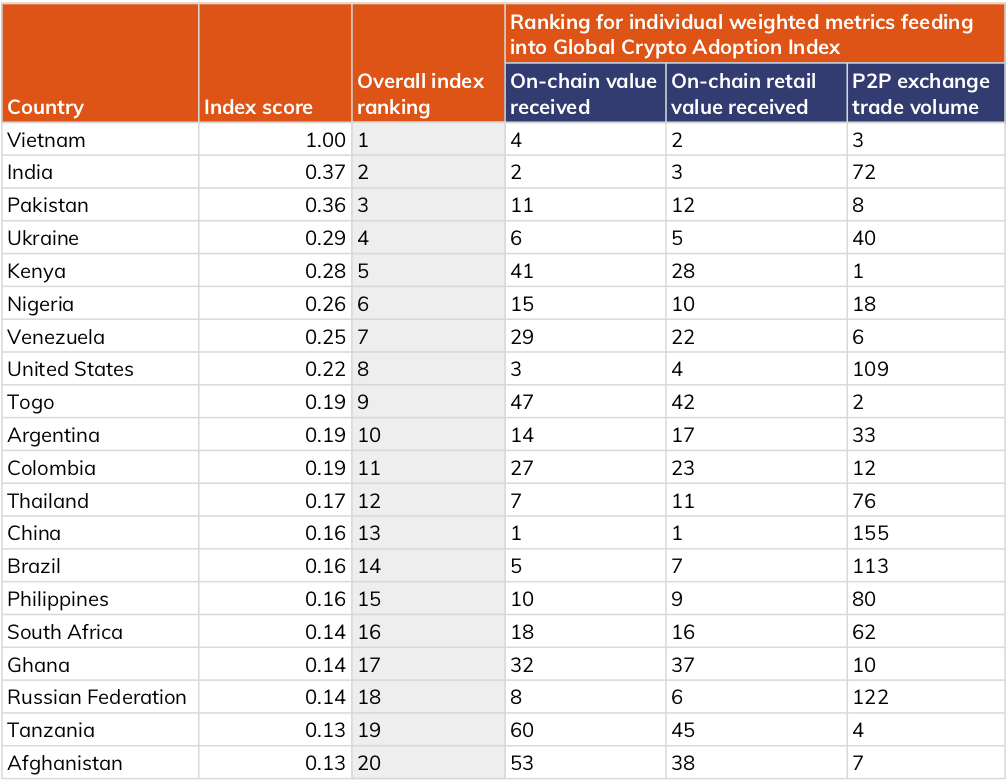

Between June 2020 and July 2021, according to Chainalysis, global cryptocurrencyA digital currency running on a blockchain and built with cryptography. Contrary to central-bank issued currency, cryptocurrency issuance rules are... More adoption grew by 880%. Among the top 20 countries with the highest cryptoassets usage, the majority are developing countries. Other economies that stand out in cryptocurrency trading are the United States, Russia, and China.

Blockchains bring a new era of flexible technologies that focus on storing and exchange of value, instant micropayments, decentralized lending, passive income, etc. Blockchain-based services could become large-scale economic solutions that solve the problem of financial inclusion worldwide. However, there are still challenges to overcome for this to happen.

Challenges in achieving inclusion with cryptos

All systems require organic evolution to function and become stronger and stronger. This is also the case with cryptocurrencies. The price of Bitcoin, for example, can currently be volatile, due to market speculation. But, as many more people adopt it as a method of payment, this volatility will decrease.

The narrative endorsed by traditional financial institutions points to cryptos being used merely for criminal acts. However, from 2017 to 2020, the use of cryptoassets for financial crimes was only 1% [Chainalysis].

Likewise, their transparency allows for greater security. The case of Silk Road (the largest darknet marketplace that operated until 2013) is a great example. The traceability of transactions on the BitcoinBitcoin is the first decentralized digital currency. It was created in 2009, by an anonymous founder or group of founders... More network made it possible to trace the flow of illicit funds traded on the platform.

In addition, the distributedA distributed system is made of components that are running on different networked computers, which communicate and coordinate their actions... More design of the blockchains makes them much more robust systems than any used by traditional financial institutions. But, as new as they are, the lack of proper regulations is another challenge. Luckily, many countries are including these assets in their legal plans already.

First education, then inclusion

To achieve financial inclusion with cryptocurrencies isn’t enough just to want it. What is certain is that financial education is first needed to enlighten (not only the unbanked) about the need for democratic and decentralized economic systems.

Otherwise, situations like the one in El Salvador, for example, could repeat. Despite Bitcoin having been legal tender since 2021 and the government spreading its adoption, citizens are still distrustful of the system. Most Salvadorans prefer to use the dollar rather than cryptos —because they know little about it. This was pointed out by a survey conducted in July 2021 in the country.

Perhaps, if you are in a country where contactless technology and 5G networks aren’t a novelty, access to financial solutions may be a no-brainer. Otherwise, if you live in a rural area, it may seem impossible.

However, the truth is that if you have access to this article, you have some Internet connectivity. That already allows you to be part of the crypto ecosystem and access a new decentralized world with financial inclusion.

Wanna trade BTCAn abbreviation for Bitcoin., ETH, and other tokens? You can do it safely on Alfacash! And don’t forget we’re talking about this and a lot of other things on our social media.

Telegram * Facebook * Instagram * YouTube * Twitter