This isn’t your typical web article, so you know. It’s more like some personal thoughts I wanted to share with all of you, guys. Cryptocurrencies are exploding worldwide, and that’s cool for everyone already inside the community. We crave more crypto adoption. Sometimes, we can’t understand why the blockchain industry isn’t even larger than it is.

エルサルバドル adopted Bitcoin as legal tender, and other territories are following. ウクライナ did it recently. The total cryptocurrency market cap amounts to $1.9 trillion, and there are over 18,800 digital assets of all kinds and prices (CoinMarketCap). We’re big…! Well, at least bigger than previous years. Bigger than what anyone would have thought in the beginning. But, probably, not as big as we could be.

A quick comparison to the U.S. stock market worth ($93.6 trillion in 2020, by The World Bank), can give us a clue about how small we’re still are —inside the great scheme of a quadrillion-worth planet. Will Bitcoin and/or cryptocurrencies be able to become a global currency, for example? There’s still a way to go, but let’s consider some points now from a not-too-new crypto user here (since 2016).

More education, and not about crypto 可決

We need more education. That sounds cliché, I know, but this one isn’t about teaching someone “What is Bitcoin”. You can explain to your granny or your kid something about a worldwide digital currency, and they probably won’t assert the difference very well between that and electronic money like PayPal or bank transfers.

Likely, they won’t understand the need or the advantages, because they already know little about the economy in general. You can’t pretend to teach someone how to analyze a book without showing them the alphabet first.

If they don’t know things like where the traditional money comes from, what’s inflation, what’s a stock, or what’s supply and demand, then it’ll be almost impossible to teach them about the real meaning of 暗号通貨 for the world, and the importance of adopting them for the future.

Currently, an awful lot of countries don’t include any kind of financial education in their schools. As a result, a fewer percentage of adults have financial literacy. There it goes the top 10 countries in crypto adoption 連鎖分析による and its financial literacy percentage by The World Bank: Vietnam (24%), India (24%), Pakistan (26%), Ukraine (40%), Kenya (38%), Nigeria (26%), Venezuela (25%), United States (57%), Togo (38%), and Argentina (28%).

As we can see, most of them have less than 50%. So, we’ll still have work ahead, and beyond cryptocurrencies themselves.

Focused services + good marketing

Not everyone needs the same thing. On a larger scale, not every country will accept or welcome the same services. You’re probably thinking about China now —yes, they didn’t welcome cryptocurrencies at all. Or did they? The truth is, they still have a Central Bank Digital Currency (CBDC) and an NFT marketplace. So, in one way or the other, they’re embracing the same technology. Just, let’s say, in a different capacity.

If the whole cryptocurrency industry was a company, the executives would be thinking about the general needs, customs, and skepticism of a nation before introducing their products there. What do they like and dislike? What is missing in their current markets? Or, more directly, what would need the product (cryptocurrencies) to succeed in that country?

Sometimes, the answer is more 規制. Some other times, the answer is more free trials for the users, more marketing for young people, and more education for not-so-young-people. Do they need an additional and risky investment or a way of living? Do they simply need more awareness about crypto adoption?

Inside the crypto world, luckily, there are all kinds of products as well. Therefore, a country may embrace 安定したコイン more than Bitcoin or Ethereum, or vice versa. If the companies or developers behind the specific coin or app (especially devs of decentralized apps) know that they can fulfill a need inside a country better than in others, then they should focus on it, and later study other possible (and maybe similar) targets worldwide.

More friendliness – less technical names

Of course, we’re already halfway there. They say there were no wallets or explorers in the beginning. And here we are, 以上で 82 crypto wallets available until 2021. Handling cryptocurrencies now is as easy as downloading an app to your phone or desktop and following the friendly instructions. But wait, that’s just for the basics: send and receive coins.

What about if you want to use one or several Decentralized Apps? What if you want to participate in a liquidity pool, mine BTC, ステーキングをする, issue new stablecoins, send 0.001 LTC via Lightning Network, or ask for a crypto loan? Well, the apps are there. More than that, the wallets are there. Most of them only allow the classic send-and-receive, but some others, like Exodus or Argent, have extra investment features.

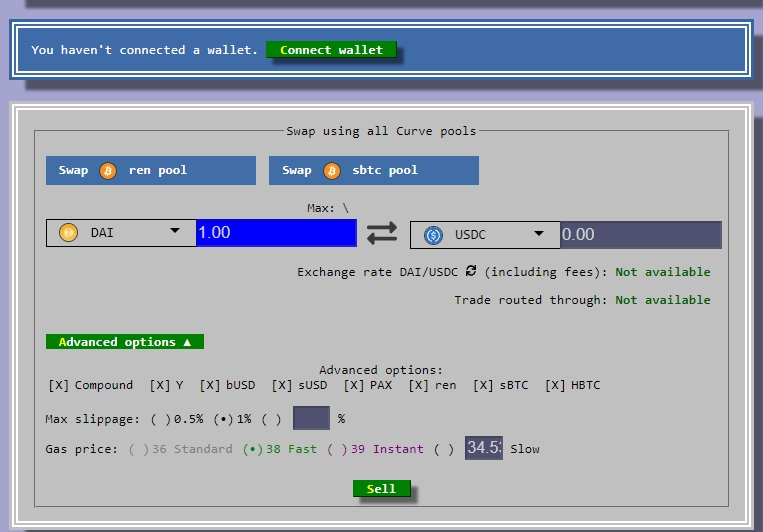

Metamask is one of the most popular for these apps, but, if you don’t know how to use them, it’s all the same. For example, we have the Curve Finance official website. It’s not exactly “friendly” for new users. We know this is a decentralized exchange for stablecoins inside the DeFi niche. However, surprisingly, it doesn’t say even that in their Home. It all starts like this:

Connect your wallet, choose your stablecoins (if you know what that is), set the slippage and gas fees (???), and good luck, my new friends. To their credit, there’s an actual FAQ on the website, but not very visible. Not all crypto apps are like this (of course), but there’s still a way to go for crypto adoption to new users.

Some intermediaries and some regulation, yes

Full decentralization means full responsibility. It’s utopic, in a way. You would need to build your own apps, store and handle your own coins (not using wallets), maintain your own servers, and, well, even make your own laws. We need others, like it or not. There are companies behind your wallet, your exchange, your favorite game or app.

People are working hard and controlling a lot of these things to offer you a better experience, and that’s ok. Crypto should be as decentralized as possible, but probably won’t ever be “fully” decentralized. We need independence, but we also need order and diversity, and that’s why we need intermediaries および規制 for more crypto adoption.

These intermediaries should offer some level of decentralization —like non-custodial exchanges. But they also need to comply with local and international laws to avoid crimes like 詐欺, hacks, money laundering, or terrorism funding. If they follow certain rules, then the people will trust more, and adopt more. Simply, because they feel safe to do it.

If everyone does as they please, it means you’re not safe there. It’s the Wild West again, and we always prefer to have at least some level of security. Investing in cryptocurrencies is risky by itself due to volatility, so, it’s not worth adding more risks to the equation.

As crypto is more mainstream, more regulations will come for it. That’s something we’re already seeing.

Remember: the opinions and insights featured in this category belong solely to its author(s) and don’t necessarily reflect those of Alfacash as a whole.

Wanna trade BTC, ETH, と他のトークン?あなたはそれを行うことができます 安全に Alfacashで!私たちはソーシャルメディアでこれと他の多くのことについて話している。

ツイッター * 電報 * フェイスブック * インスタグラム * Youtube * Vkontakte